There are a lot of different little (and big) charges that you could be responsible for while on Medicare.

Medicare does not cover everything. Copays, deductibles, coinsurance, and premiums can add up and be very expensive.

There are different programs available to help with your out-of-pocket. Some are conventional and some are not. Medicare Supplements, Medicare Advantage, and Part D drug plans are just some of the ways to lower costs while on Medicare.

In this article, we’ll cover 15 options that are available to reduce your out-of-pocket, including different insurance programs, discount programs, and drug programs that all help in lowering your costs.

Everyone’s situation is different and not every program may be right for you. Recognizing what your needs are and doing the proper homework can help you determine which direction you need to take.

Keep reading to learn about the different ways to reduce your out-of-pocket costs while on Medicare.

1. Medicare Supplements

Medicare Supplements are one of the most popular ways to lower your out-of-pocket costs. They work with original Medicare to limit your responsibility if you were to ever have any kind of procedure or hospital stay.

Generally speaking, Medicare only covers about 80% of your medical bills. If you do not have any kind of Supplement or secondary coverage, you could be responsible for 20% (or more) of your visit.

Both Part A and Part B are considered Original Medicare. You can read more about A here and B here.

Medicare Supplements are plans that are standardized by the government. There are 10 to choose from. All have different prices and coverage. You can read about the basics of Medicare Supplements here.

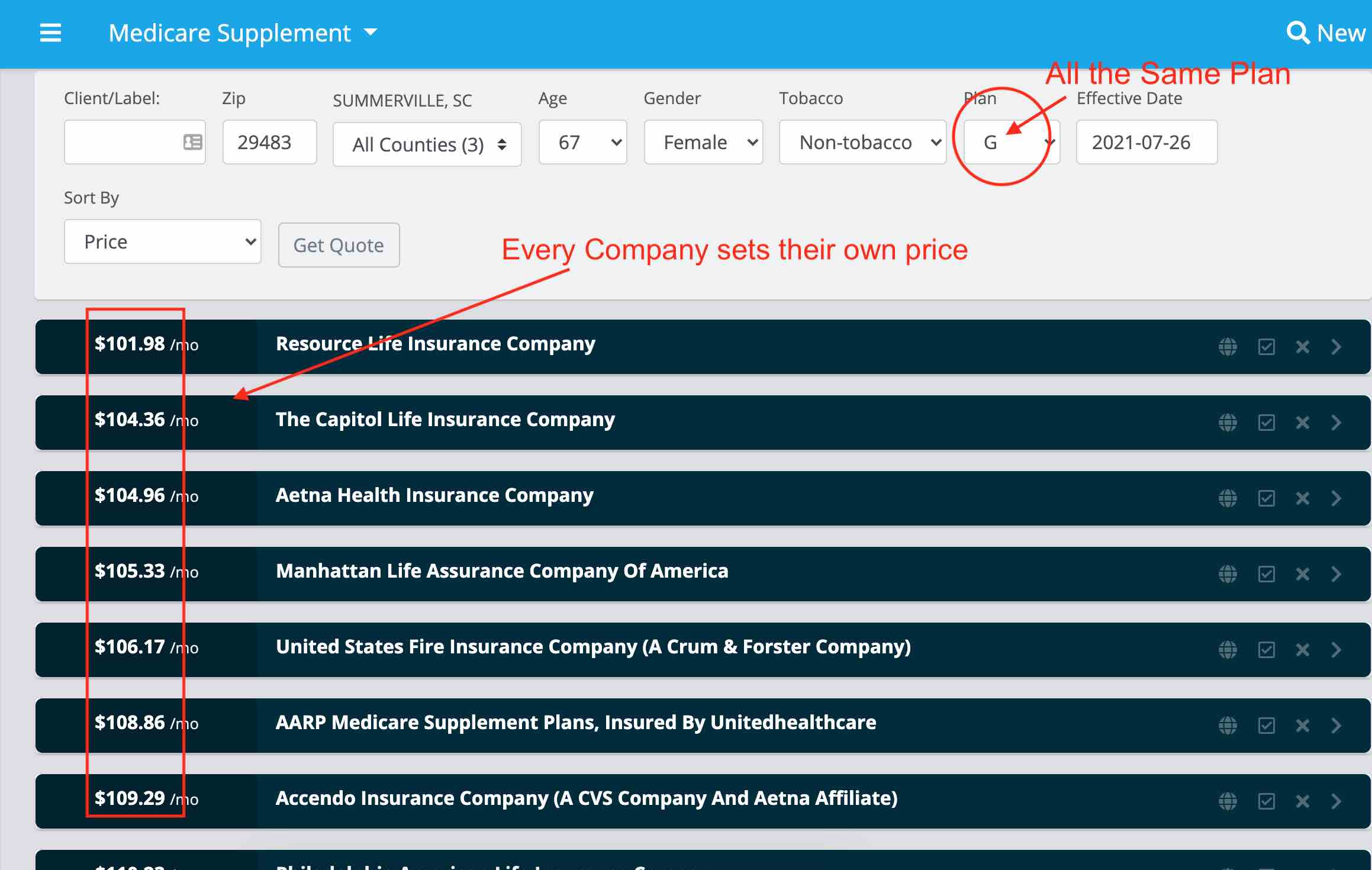

When choosing a Medicare Supplement, remember to compare letter to letter. Plan G is the same exact coverage from one company to the next.

As long as your doctor accepts Medicare, the Supplement will also be accepted – regardless of what company you are with.

If you look at the image below, you’ll notice the different prices for the same plan. Rates are determined by age, gender, location, tobacco status, marital status, and sometimes height and weight.

Keep in mind, the rates in the image below are at the time of writing this article and are an example only. These prices may change at any time.

Notice the price is different from one company to the next.

The biggest question we get, as a brokerage is, “why would anyone choose any other company but the one with the lowest price?”

It is very simple, not every company has a good rating or is maybe too new in the market.

After we pull a quote, we spend time educating customers about the different companies and their ratings.

For example, it makes complete sense to pay $2 more for an A-rated company vs a company that is too new to have a rating.

If you want to learn about the most popular Medicare Supplements, you can read about them here.

Qualifying for a Medicare Supplement

When you are first new to Medicare, you won’t have to go through medical underwriting to qualify for a plan. Regardless of your health, you can get any plan of your choosing.

If you’ve been on Medicare for a while and want a Supplement, you’ll have to qualify for a plan with your health. You’ll go through a series of questions that is part of an application process. Depending on your health, you may not qualify.

In most cases, if you have health issues, you are usually better off going with a Medicare Supplement. There are no special enrollment periods for Supplements, as long as your health is good, you can get one at any time.

Supplements do not offer any prescription drug coverage. If you decide that a Medicare Supplement is the best option that fits your needs, you’ll need a separate Part D drug plan. We will talk about those later in this article.

Out of all the ways to lower your out-of-pocket while on Medicare, Supplements offer the highest level of coverage.

2. Medicare Advantage Plans (MA Plans)

Unlike Medicare Supplements, Medicare Advantage Plans are all very different from one another.

The biggest differences between the plans are their prices, plans, coverages, copays, out-of-pocket, star ratings, and networks.

You cannot have a Medicare Supplement if you are on Medicare Advantage.

Medicare Advantage, also known as Part C of Medicare, is an alternative to Original Medicare. If you decide this is the best option for you, you’ll no longer use your red, white, and blue Medicare Card.

Instead, the Advantage Plan you choose becomes your primary insurance.

When picking an Advantage Plan, you’ll need to make sure that all of your providers are covered.

Typically if you go to a doctor that is not covered, you’ll end up paying more.

Be careful though, not all Medicare Advantage Plans offer prescription drug coverage.

If you need coverage for prescriptions, a MA plan is not a good fit to meet your needs.

Instead, you’ll want to consider a Medicare Advantage Plan that includes drug coverage, known as an MAPD plan.

If you opt-out of having a plan that includes coverage for your medications, you’ll pay a penalty to Medicare.

3. Medicare Advantage That Includes Drug Coverage (MAPD)

Just like a MA plan, you’ll shop a MAPD plan the same way.

Most importantly, you’ll want to make sure ALL of your doctors are covered. However, in addition to your doctors, you’ll need to check that your medications are covered as well.

The prescriptions you take, dosages, quantities, and the pharmacy you use all play an important role in which Advantage Plan is the best option.

If you are talking to an agent and they do not take the time to make sure your doctors and prescriptions are covered, you’ll want to think carefully before working with them.

Not all Advantage Plans are the same. Make sure you take your time and do your homework.

If you are not new to Medicare, you’ll have to wait until the Annual Enrollment Period (Oct. 15th – Dec. 7th) before you are able to apply for a Medicare Advantage Plan

Learn more about different enrollment periods here.

4. MSA Plan

Also known as a Medicare Medical Savings Account, is a type of Advantage Plan that is similar to a Health Savings Account.

There are 2 levels of coverage in an MSA plan. A high deductible health insurance policy and a savings account dedicated to paying for your Medical Expenses.

Before you have any coverage, you’ll need to meet the yearly deductible (which varies by plan). You can pay for the deductible out-of-pocket, or use the money that is available in your MSA account.

You can use that money for any and all healthcare-related costs, even if Medicare does not cover them. When you use up all the money, you’ll be responsible for all charges until you meet your plan’s deductible.

If you have money left over at the end of the year, that money rolls over into the next year.

MSA plans offer the same level of protection as traditional Medicare Advantage Plans once you meet your yearly deductible. They do not, however, offer prescription drug coverage. You’ll need a separate Part D Drug plan.

When buying an MSA, you should follow the same principles when choosing a plan as you would with a Medicare Advantage Plan.

5. Part D

Part D is a program through Medicare for prescription drug coverage.

As you’ve read in this article so far, Original Medicare, MA Plans, MSA Plans, Supplement Plans, do not offer any prescription drug coverage. You’ll need to apply for Part D if you want your medications covered. If you opt-out of Part D, you’ll pay a penalty.

Most generic prescriptions are pretty inexpensive but if you have more serious conditions, you can find yourself paying hundreds, if not thousands of dollars if you do not have the right plan.

When choosing a Part D plan, you’ll want to make sure the plan you are considering covers all of your medications.

Depending on what you take and what pharmacy you use determines what plan will offer the best coverage.

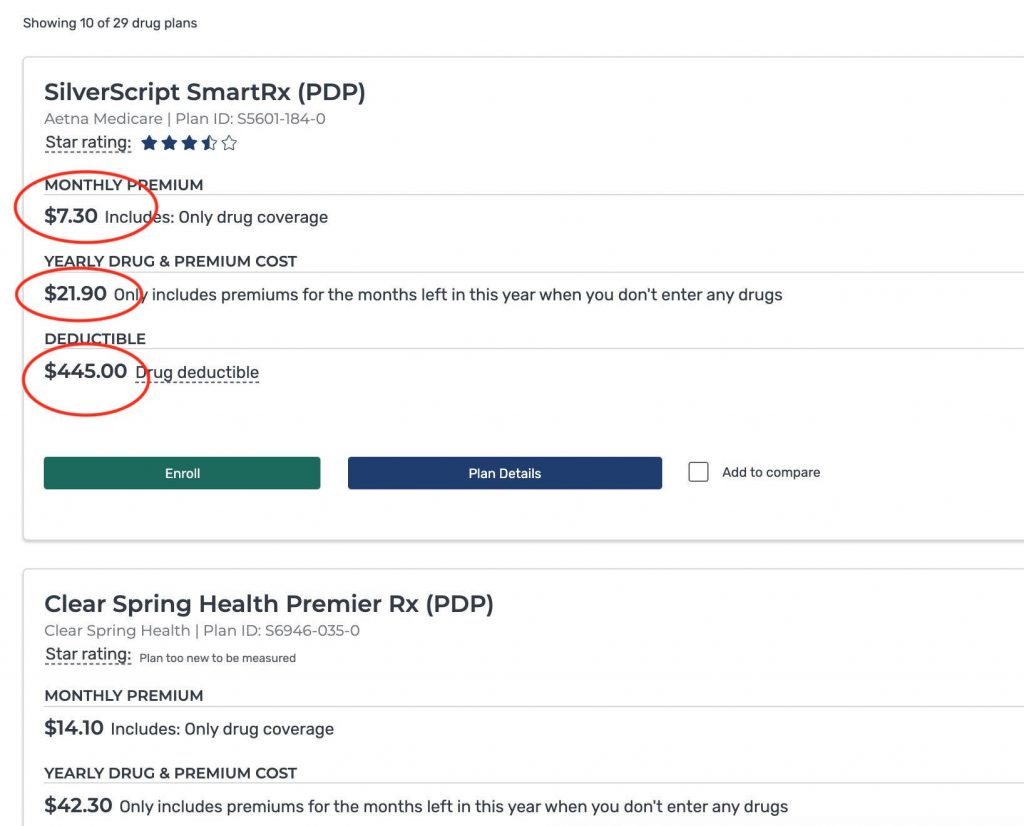

Part D plans have different levels of coverage.

They consist of copays, deductibles, coinsurance, and tiers of coverage (see example below). Each plan has a different monthly cost. Depending on what level of coverage you need will determine how much that plan will cost you.

Read more about Part D plans here.

6. Group Benefits

Not everyone who is Medicare eligible has the same type of situation, especially when it comes to employer coverage.

When you finally reach Medicare age, you will either continue working or retire. If your employer offers you health insurance benefits, there are a few things you’ll need to keep in mind.

As we mentioned above, Medicare does not cover everything and there certain gaps in coverage that you’ll need help with.

If you have employer coverage, you may want to keep those benefits instead of opting for a Medicare Supplement or Advantage Plan. Chances are, your health insurance may also include prescription drug coverage, in which case, you won’t need a Part D drug plan either.

The question most people ask is, “should I keep my employer coverage if I am eligible for Medicare?”

Here are a few follow-up questions I like to ask to better understand someone’s situation.

- Will you continue working?

- If you retire, can you keep your employer benefits?

Continuing to Work

If you continue working and your employer allows you to keep your health insurance, you may want to postpone enrolling in Medicare Part B.

You’ll avoid paying any kind of late enrollment penalty if you decide to delay Part B as long your current health insurance is considered creditable coverage.

Medicare Part A, when you are eligible, will become your secondary coverage and your employer’s health insurance will stay primary.

In other words, nothing about your current plan changes, while at the same time, you’ll add benefits when Part A kicks in.

When you are ready to retire, you’ll have an Open Enrollment period that will start 2 months before your retirement date.

At that time you’ll have the option to sign up for Part B and either choose a Medicare Supplement or Advantage Plan.

Learn if it’s a good idea to keep your employer coverage while on Medicare here.

Retiring with Employer Coverage

If your employer offers health insurance when you finally retire, you’ll need to decide if you actually want to keep that coverage.

Remember, you do not have to. However, comparing all of your options is the smartest way to maximize your health benefits in retirement.

Here are some of the things to consider when you’re deciding if your employer coverage is the right option.

- Price

- Benefits

- What kind of coverage it is

- Is the coverage actually through your employer (or did your employer hire the broker to help you choose a plan)?

Let’s briefly talk about each one.

Price

The biggest factor in deciding if you should keep your employer plan.

Always look at how much it costs and then compare it to your benefits.

Is the price and what you are getting better than what you can get with a traditional Medicare Supplement or Advantage Plan?

Benefits

As we mentioned above, what kind of benefits are they? How are the networks? How flexible are the providers when you use the insurance?

The most important part of any health insurance is the benefits.

Just like the price, how do the benefits compare to plans that you can buy elsewhere?

Type of Coverage

The type of coverage you are getting is also important. Does the coverage meet your needs when you need it most?

Some employers may offer Advantage Plans or Medicare Supplements disguised as retirement health insurance.

Usually, if this is the case, they’ll cost more than going direct to the company or hiring an insurance agent to do the work for you.

Is the Coverage Through a Broker?

Sometimes companies may use a third party to help you with your health insurance in exchange for a lump sum dedicated to an HSA account.

If this is your situation, always compare those benefits to benefits you can get somewhere else. Be careful, your employer may not always let you do this.

Quick Summary of Group Benefits

Whether you continue working or plan to retire, it is always best practice to compare what your employer is offering to plans you can get privately.

Every situation is different, so it is always crucial you ask as many questions as you can.

Just because you are eligible for employer coverage, doesn’t mean that it’s your best option – no matter how long you’ve worked for those benefits.

They may not always be as good as they seem or the best option for your specific situation.

7. VA Benefits

If you have VA benefits, going on Medicare expands your level of care and coverage.

Using the VA, you’re probably accustomed to the restrictions that come with your coverage. The most common being limited to your choices in hospitals and providers.

It is very common for VA beneficiaries to travel several hours to their nearest VA hospital for care.

If the VA requires you to only see their doctors and hospitals, going on Medicare will expand the network that you’re usually used to.

Remember, Medicare does not cover everything. If you need coverage closer to your home, Medicare will allow you to use one of their providers.

Keep in mind, the VA won’t pick up the difference of what Medicare doesn’t cover.

This is why you’ll still want to consider some kind of Medicare Supplement or Advantage Plan to help pick up gaps left in your coverage.

VA benefits usually include coverage for prescription drugs which means you won’t get penalized if you opt-out of drug benefits through Medicare’s Part D program.

Here Are a Couple of Things to Remember:

- You can still use the VA, even if you are Medicare Eligible

- You are required to apply for Part B or you’ll be penalized

- You’re not required to apply for Part D

- A Supplement or Advantage Plan is a good option, even in addition to the VA

8. TRICARE for Life

If you qualify for TRICARE you’ll need to make sure to apply for both Parts A and B whenever you become eligible.

TRICARE is a health program for uniformed service members and their families. Depending on your level of service, you may qualify for TRICARE in addition to your VA benefits.

Even though TRICARE is free, you’ll still be required to pay for Part B.

Once the coverage kicks in, Medicare will be your primary coverage and TRICARE will be your secondary.

You won’t need any kind of Supplement or drug plan since TRICARE will cover it all.

In addition to being your Supplement and drug plan, TRICARE also provides dental coverage.

If you qualify, TRICARE is the best option while being on Medicare.

9. Indemnity Polices

An indemnity policy is a type of health plan designed to pay you for certain illnesses, procedures, hospital stays, and doctor’s visits.

Unlike health insurance, which pays based on you receiving an actual medical bill, indemnity policies pay according to the pre-defined schedule (or amount) that’s written in the policy.

Indemnity policies pay for

- Hospital stays

- Doctors visits

- Surgeries

- Drugs

- Accidents

- Dental care

Just to name a few.

When you purchase an indemnity policy, you’ll choose a predefined amount the policy covers and what the coverage is for.

You can buy an indemnity policy in addition to any insurance you may already have. They do not affect the coverage of your primary insurance and always pay you instead of the hospital.

They are not health insurance but do provide vital benefits if you are looking to fill certain gaps in coverage that you may have.

For Example:

Let’s say you get diagnosed with cancer.

Medicare will pay 80% of the bill and any Supplement you have will pay the other 20%.

If you have an indemnity policy that has a lump-sum cancer benefit of $20,000, you’ll receive a check in the mail for the entire amount upon the diagnosis of the illness.

So not only will Medicare and the Supplement pay your entire bill, you’ll have money left over to do as you please.

Let’s say you decide you don’t want to get treatment, the indemnity policy will still pay you.

Indemnity Coverage and Medicare Advantage

As you know, Medicare Advantage Plans typically have lots of gaps in their coverage, especially when it comes to major hospital stays.

Some plans require you to pay as much as $350 a day if you are an inpatient in a hospital.

An indemnity policy can fill that gap in your coverage so you have less out-of-pocket if something major happens to you.

If you are considering a Medicare Advantage Plan, ask your agent if an indemnity policy is a good fit for you.

10. Extra Help Program

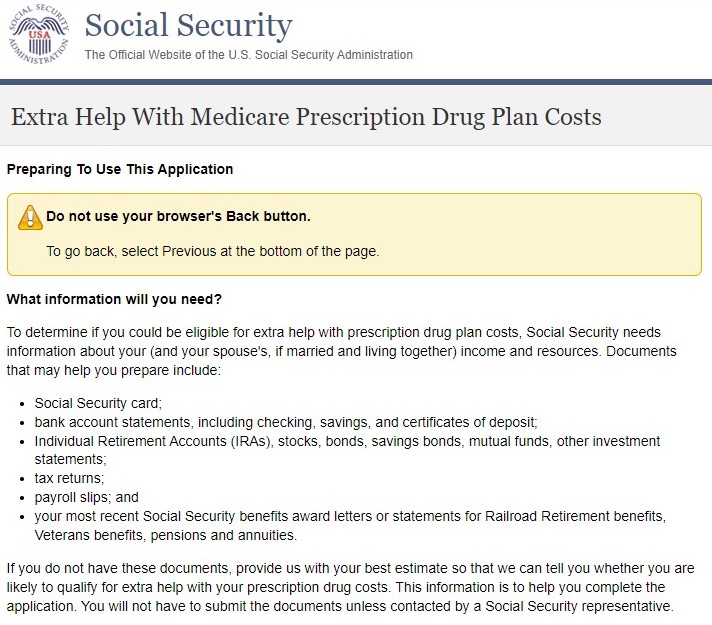

If you are a low-income household, you may qualify for extra help programs that will help pay for your Part D Medications.

Extra help programs are designed to pay for things like deductibles, copays, coinsurance, and premiums.

If you cannot afford the cost of your medications, you may consider applying.

To see if you qualify, click here.

11. Medicare Savings Programs

Just like the Extra Help Program, the Medicare Savings Program is for low-income individuals who cannot afford the cost of their Part B Premiums.

There are different levels, all based on your income.

Some levels of the program pay for deductibles, copays, and coinsurance in addition to the monthly premium.

To learn more about these programs, you can visit this article here.

12. Medicaid

Medicaid is a state-run program designed for low-income households and for people who have certain illnesses.

If you are eligible for Medicare and Medicaid, you may be able to qualify for certain benefits that are not available if you have Medicare only.

Some Advantage Plans expand your level of coverage which helps offer programs in addition to Medicare and Medicaid.

Talk to your agent and see what options are available in your area.

13. Drug Coupons

Even with Part D coverage, you may find that certain medications are not covered under any company’s formulary.

Or, a Medication that is covered, may be very expensive, even with Medicare’s drug program.

If you find yourself in this situation, you can always ask your provider for samples (although not the ideal solution, and is usually a temporary fix).

Some pharmaceutical companies offer coupons that you can use to reduce the cost of the medication.

The best place to start looking at drug coupons is goodrx.com. They have an easy search feature where you can look up your prescriptions.

If you cannot find a coupon with websites like the one mentioned above, you may want to research the actual drug manufacturer’s website to see if they have one available.

Coupons are a great way to save money on prescriptions, even if you do have other coverage in place.

14. Online Pharmacies

Online Pharmacies are actual stores that sell prescription drugs over the internet. Just like walking into a Walmart or CVS, you can buy your medications online.

These pharmacies usually offer medications at lower prices because they require less overhead to operate.

Mail-order drugs have become very popular in the last couple of years. Not only are they convenient, they usually have the best prices on name-brand and generic medications.

Even companies like Amazon have begun selling drugs online.

Most online Pharmacies accept Part D and Advantage Plans as a form of payment.

Ask your pharmacist which medications you should buy online instead of a retail box store.

15. Dental Vision and Hearing Plans

It is no secret that original Medicare does not offer any type of coverage for dental, hearing, or eye care.

Unless it is an accident to your eyes, ears, or mouth you’ll be left paying the entire bill.

Routine dental visits and eye exams can be expensive. A pair of glasses or hearing aids can leave you paying hundreds of dollars if you don’t have any additional coverage.

Most companies offer some kind of dental, vision, and hearing policies that you can purchase in addition to your Medicare.

Just like any type of insurance, levels of coverage and prices differ between companies.

Do your homework or work with a broker to determine which plan is best for you.

Summary

As you can see, there are a lot of different ways to lower your out-of-pocket cost when one Medicare.

Depending on your situation, one program may work better than another.

If you find yourself where you need help understanding which options are best for you, we offer a free service that helps people like you who are new to Medicare.

Working with an independent broker not only saves you money but will cut out all the work you’ll have to do researching every different program.

If you have any questions we would love to help.

Leave A Comment