If you are like most people going on Medicare for the first time, you will probably have the same question.

The best Medicare Supplement for someone new to Medicare is High Deductible Plan G. It provides the most coverage while being the lowest priced Plan. HDG costs anywhere between $30-$45 a month, where most other plans are twice the price. It covers everything in addition to Medicare after you pay a small deductible.

High Deductible Plan G, or HDG for short, is a Medicare Supplement that you purchase in addition to Medicare to cover the out-of-pocket costs that Medicare does not cover.

We will talk about what HDG is, how it works, and what it covers. We will also look at situations where High Deductible is not a good fit.

Keep reading to learn more.

High Deductible Plan G Is a Standardized Medicare Supplement

Medicare Supplements, or Medigap Plans, are the coverage you can purchase in addition to Medicare.

If you want to learn the basics of Medicare, you can read these posts about the different parts to Medicare: Part A and Part B.

Generally speaking, Medicare only covers about 80% of approved medical expenses. The rest is your responsibility. There is no maximum out-of-pocket, which means there is no telling what your costs could be.

It’s important to have some protection to limit your exposure to ever-increasing medical costs.

Medicare Supplements are the best way you can do this.

All Medicare Supplements are standardized; this means that the coverage is the same, no matter the company.

Plan G is one of ten standardized plans available, but the only one with a high deductible option.

What Does High Deductible Plan G Cover?

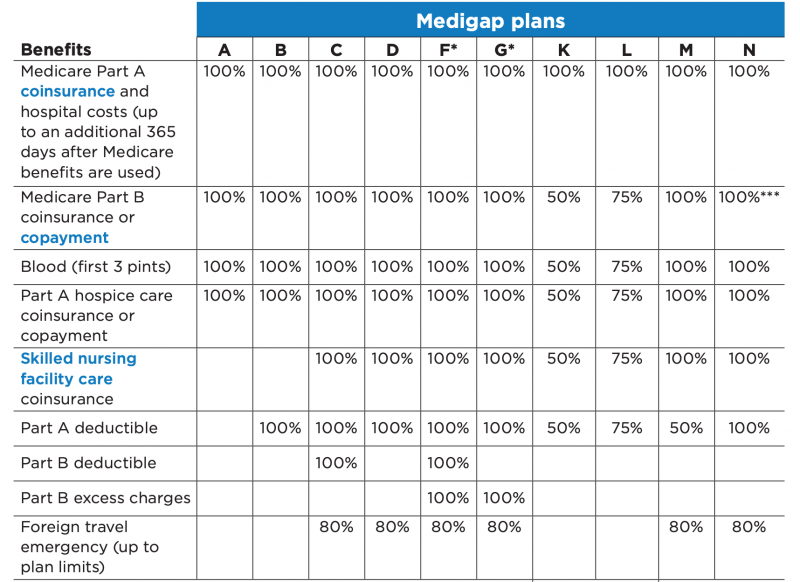

The “Medicare and You” Guide includes a list of the 10 Medicare Supplements available to you.

This list also consists of an outline of coverage that explains what is covered.

As you can see below, Plan G and High Deductible G have the same coverage:

*Note – If you were new to Medicare, before January 1st, 2020, you cannot get High Deductible G. High Deductible F is your option. Do not worry. Everything is exactly the same as HDG. Everything in this post still applies, except you’d be getting HDF instead of HDG.

The only difference between Plan G and High Deductible Plan G is a one-time yearly deductible.

In 2022, the deductible was $2,490. Once you meet this deductible, everything is covered 100%.

High Deductible Plan G covers:

- Medicare Part A coinsurance and hospital costs

- Medicare Part B coinsurance or copayment

- Blood (first 3 pints)

- Part A hospice care coinsurance or copayment

- Skilled nursing facility care coinsurance

- Part A deductible

- Part B deductible

- Part B excess charges

- Foreign travel emergency (up to plan limits)

You may be wondering why you should choose a higher deductible vs. a plan that may have a smaller pocket.

The answer to that question is cost.

Keep reading to learn more.

Here’s an example:

You are finally old enough to go on Medicare! You are retiring and need a plan to help pay for what Medicare doesn’t cover.

Maybe you are considering High Deductible Plan G because you are very healthy, rarely see a doctor, and don’t take any medications – the ideal candidate.

But – let’s say you walk out of your house one day, and you slip and fall.

You end up in the emergency room, they put a brace on your wrist, and now your doctor recommends hip surgery.

As you know, Medicare Part A and Part B both have coverage gaps that leave about 20% of your medical bills your responsibility. If you don’t know how Part A or Part B works, I recommend you read those articles first.

After your visits and procedures, your bill looks a little like this:

ER Visit – $600

Wrist brace – $200

Pain medications – $400

X-ray – $250

Hip Surgery – $32,000

Anesthesia – $2,400

Total: $35,850

As you know, Part A only covers inpatient medical stays, so Part A pays nothing.

Part B is outpatient medical coverage, so you’ll have to meet the Part B deductible first ($233 in 2022), then they pay 80%.

High Deductible Plan G covers 100% of everything after you meet your HDG deductible.

In the example above, you would have paid $2,490.

Let’s use one more example:

What if the situation wasn’t as serious as the example above and you did not need hip surgery?

Suppose after your slip, you go to the ER and only get an x-ray and a brace.

From the example above, the cost would be $1,450 (assuming they gave you the pain meds also).

Again, Part A would pay nothing. Part B would pay 80% after you meet the Part B deductible.

So you would pay $476.40:

$1,450 – $233 (Part B Deductible) = $1,217

$1,217 x 20% (Part B Coninsurance) = $243.40

$243.40 + $233 = $476.40

You’ll continue to pay like this until you meet the HDG deductible. Once that deductible is met, everything is covered 100%.

How Are Rates Calculated?

One of the most important things you can do when buying a Medicare Supplement is to compare the cost and coverage from several different plans.

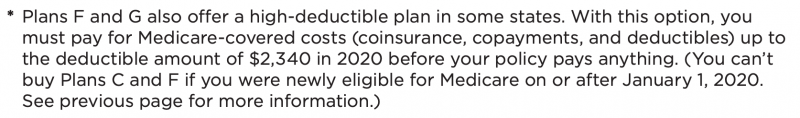

When generating a quote, your age and where you live will determine the cost of your plan.

To pull the most accurate quote, we ask for:

-

- zip code

- age

- gender

- if you are a smoker

- if you are married

Here’s an example of what is needed to run a quote:

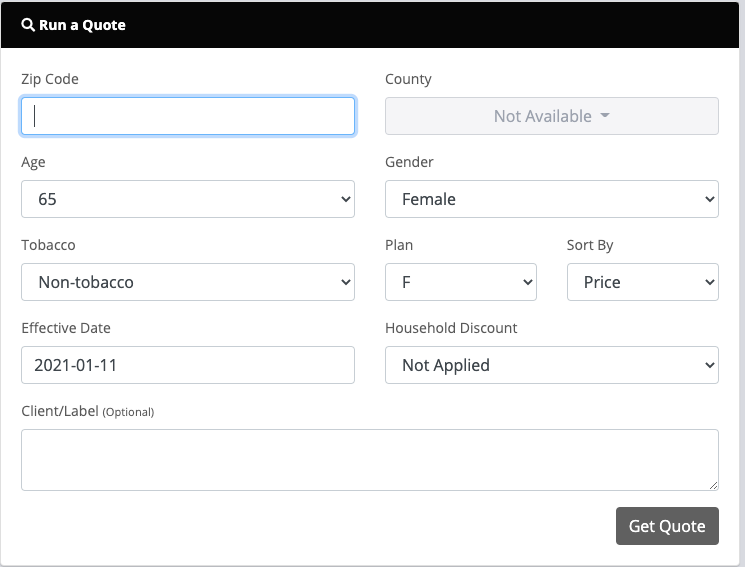

Let’s take a look at a quote for Plan G:

So how much lower is the cost?

We need to pull a quote in several areas to see the price differences.

Let’s say in this example, that someone is turning 65 this year and lives in Fort Lauderdale, Florida.

Female, non-tobacco user.

Notice how the lowest rate for Plan G is $217.61:

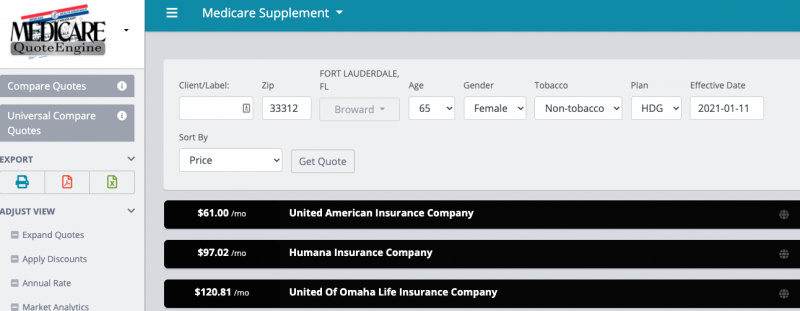

Now let’s take a look at a quote for the High Deductible Plan G:

Now let’s see what High Deductible Plan G rates are in the same area.

Same conditions – someone is turning 65 this year and lives in Fort Lauderdale, Florida.

Female, non-tobacco user.

Notice how the lowest rate for HDG is $61.00:

Again, the lowest rate for Plan G is $217.61, and the lowest for HDG is $61.00.

That’s a price difference of $1,872 a year.

As you already know – every plan is going to have a rate increase. Let’s assume an 8% rate increase every year on both plans.

In 5 years, Plan G is going to cost $296.06 while HDG will only cost $82.99.

So over five years, you’ll save $10,989.36!

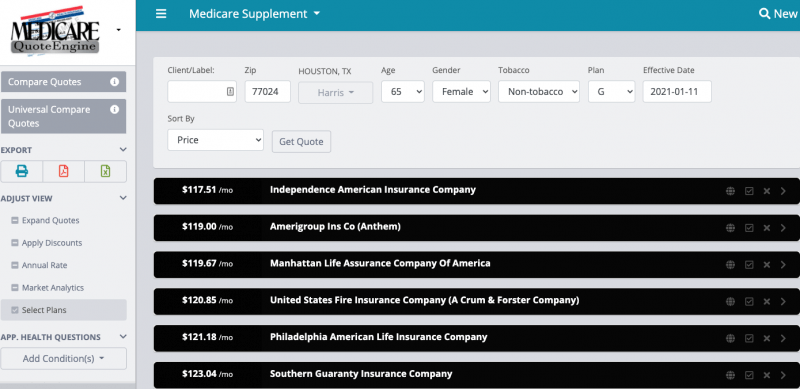

Let’s take one more look at a quote for Plan G:

We have a female turning 65 in Houston.

She does not use tobacco.

Notice how the Plan G price is $117.51:

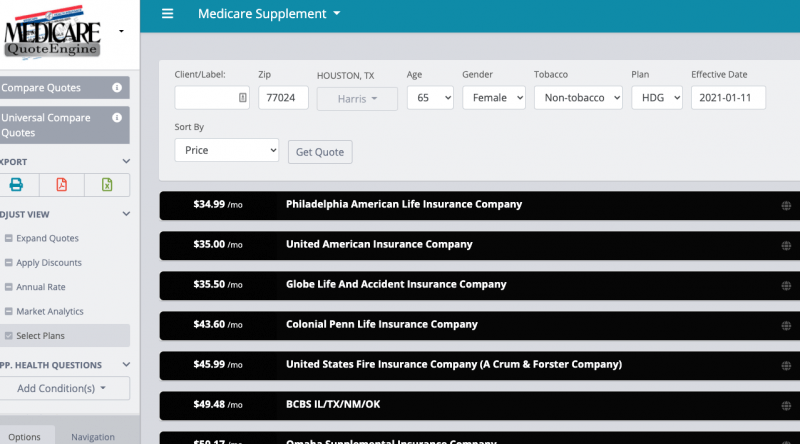

Now let’s take one more look at a quote for the High Deductible Plan G:

Same deal – we have a female turning 65 in Houston.

She does not use tobacco.

Notice how the quote for HDG is $34.99:

Again, the lowest rate for Plan G is $117.51, and the lowest for HDG is $34.99.

That is a price difference of $990.24 a year, and $5,612.16 over 5 years.

That is a big difference!

When Should I Consider an HDG Plan?

Cost vs. Benefit should always be the deciding factor.

Even if you have one medical event, over a five-year period, you’d still spend less than if you had a plan with a lower deductible.

As you saw in the examples above, it doesn’t take much time for an agent to pull a quote. A simple comparison, and you’ll have all the numbers.

Since all Medicare Supplements are standardized, there is no difference from one company to the next when choosing a plan.

I would, however, caution against working with a company that does not have an A rating or higher.

If the cost in your area is significantly lower than any other plan, HDG is a good fit.

Here are some of the main reasons I would recommend High Deductible Plan G:

- If you are healthy

- Do not take any medications

- Rarely go to the doctor

- If a plan with a smaller deductible is significantly more expensive

- You want to save money

- No network restrictions

- Can afford a higher deductible

When would High Deductible Plan G not be a good fit?

If you are working with an agent, there are a few questions they should ask to understand your situation better.

A needs analysis will help determine if a High Deductible Plan G is the right solution.

If you go to the doctor all the time, take a lot of medications, or are in the middle of procedures, it makes more sense to have a lower deductible.

Sometimes the price might not be all that different between HDG and a lower deductible plan.

In some areas, we found companies do not offer HDG at all.

Remember, all of the plans are standardized – so companies cannot choose benefits. Companies, however, can choose if they offer a plan in any one area.

Working with an independent agent that will give you unbiased advice usually will get you the best deal.

Remember, always ask questions!

When Can I Apply?

If you are new to Medicare, you can apply at any time. Most companies give you a six-month window before your effective date. Then, you’ll have six months after you first go on Medicare.

Maybe you’ve been on Medicare for a little while, then you’ll have to go through medical underwriting before you can apply.

In most cases, it’s just a few simple questions. There may be times, though, that you wouldn’t be able to get approved.

If you can’t get approved for a High Deductible Plan G, chances are it’s not a good fit. Above I mentioned that if you go to the doctor a lot or have some serious preexisting conditions, you should not consider an HDG.

In general, Medicare Supplement Plans increase in cost every year. If you keep receiving rate increases and are in good health, you may want to consider looking into an HDG.

There are no special enrollment periods when applying for a Supplement. You can do it at any time.

However, if you have an Advantage Plan, you may not be able to leave that plan until the Annual Enrollment Period (October 15th – December 7th). You can read about Advantage Plans here.

Summary

As you can see, in a lot of cases, High Deductible Plan G is something you should consider.

In the examples above, the savings make a lot of sense. Even if you were to break even, the lower rate increases would be a good reason to get HDG.

The most important part to remember: work with an agent who has your best interests at heart.

Spend an extra few minutes and weigh all of your options. You’ll be glad you did.

If you have any questions, please don’t hesitate to call our office or send us an email.

Our phone number is 888-209-5049.

Leave A Comment