People going onto Medicare for the first time usually have a lot of questions when it comes to drug benefits.

Do I need a drug plan? Are my medications covered? How do I pick the best drug plan? If I don’t take any medications, can I wait to sign up for a drug plan? When can I enroll?

Let’s talk about Medicare Part D, how it works, and how to pick the best plan.

If you cannot afford Part D drug coverage, read this article that shows how you can lower some of your out-of-pocket costs and apply for extra help.

Medicare Part D is Prescription Drug Coverage.

Medicare-approved private insurance companies offer Part D plans.

Part D plans pay for drugs not covered by Part A and Part B.

If you have original Medicare Part A and Part B, you can enroll in a Part D plan to add prescription drug coverage.

If you have a Medicare Advantage plan, prescription drug coverage is likely already included. If it is not, you can enroll in a separate Part D prescription drug plan.

Be careful – some Medicare Advantage plans may not let you get a separate drug plan.

Read about Medicare Advantage plans here.

All plans that offer Part D coverage must cover standard medications decided by Medicare.

There May Be a Penalty for Not Signing Up.

If you decide to delay enrollment because you are still working or not taking any medications, you may have to pay a late enrollment penalty. Please keep reading to learn about the penalty and how much it is.

Here are some examples of drugs that all Part D plans must cover:

- Drugs used to treat cancer.

- Drugs used to treat HIV and AIDS.

- Antipsychotics and antidepressants

- Anti-rejection medications for transplant recipients

Beyond these standard medications, each plan decides what drugs it will cover.

No Part D prescription drug plan covers every single prescription drug.

A formulary is a list of drugs that a plan covers.

Each plan has what is called a formulary.

Let’s talk a bit more about formularies.

Formularies

Each Part D plan includes brand-name and generic drugs in its formulary.

Every formulary must include at least two drugs from each class. A class of medications is simply all similar prescriptions used to treat the same condition.

For example, atorvastatin, simvastatin, pravastatin, and rosuvastatin are all drugs used to lower cholesterol.

They are all considered to be in the same class.

If you take a drug not covered by your plan, there is likely a similar drug on your plan’s formulary.

If your doctor feels taking a similar drug would be unsafe, you and your doctor can request that your plan make an exception to cover the drug that is not on your plan’s formulary.

Most Part D plans categorize the drugs on their formularies into tiers.

Tiers

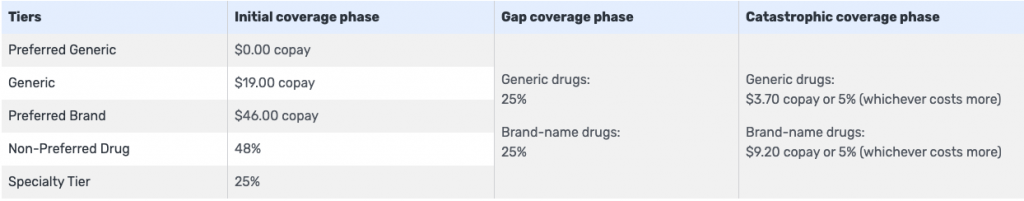

Each Part D plan can categorize the drugs on its formulary into different tiers:

- Tier 1 – Low-cost generic drugs

- Tier 2 – Preferred brand-name drugs

- Tier 3 – Non-preferred brand-name drugs (these are generally higher-priced Tier 2 equivalents)

- Tier 4 – Specialized medications

- Tier 5 – Highly specialized medications

The cost of drugs in a particular tier differs from plan to plan.

Typically drugs in a higher tier cost more than lower-tier drugs.

What Is Not Covered?

A Part D plan will not cover any drug that is not on its formulary.

Here is an example of some of the medications that Medicare and Part D plans will generally not cover:

- Over-the-counter medications not prescribed by a doctor

- Vitamins and minerals with or without a prescription

- Drugs taken for cosmetic purposes.

- Drugs used to treat sexual dysfunction.

- Part D plans will also not cover drugs that are covered by Part A and Part B.

- Medications administered in the hospital (already covered under Part A).

- Prescriptions in a doctor’s office that are already covered by Part B.

How Much Does a Part D Plan Cost?

Out-of-pocket costs vary from one Part D plan to another. Here are the expenses you will generally have on any Part D plan:

- Monthly premium

- Deductible

- Copayments and coinsurance

Let’s talk about each one individually.

Monthly Premium

Your Part D monthly premium is the amount you will pay monthly to have the plan in place.

Monthly premium amounts vary from one Part D plan to the next, but most people pay somewhere between $15-$30.

Some plans have much higher monthly premiums. These typically cover higher-tier medications better than other programs.

Most people pay the plan’s standard monthly premium.

If your modified adjusted gross income is higher than a certain amount, you will likely pay an Income Related Monthly Adjustment Amount (IRMAA).

Medicare will make this determination based on the reported amount on your tax return from two years before getting on a Part D plan.

If you are required to pay a higher amount, you will have to pay this amount to Medicare in addition to paying your monthly premium to your plan.

If your income is low, you may apply for extra help if you cannot afford your medications.

Deductible

Most Part D plans have an annual deductible.

The annual deductible is the amount you must first pay for your prescription drugs before your Part D plan pays its portion.

The deductible can vary from one plan to the next but can not exceed $480 (2022). The standard deductible amount changes slightly every year. Medicare’s website has the updated amounts.

Some Part D plans do not have a deductible, but they usually cost a lot more.

Copayments & Coinsurance

A copay is a set dollar amount that you pay for each drug you have filled, depending on that drug’s tier.

Tier 1 drugs often have little to no copay. Tier 2 drugs generally have a slightly higher copay, and Tier 3 drugs even higher.

Coinsurance is like a copay in that it is the amount you pay to fill a drug, depending on that drug’s tier.

However, instead of a set dollar amount, coinsurance is a percentage of that drug’s cost.

It is common to have a coinsurance associated with Tier 4 and Tier 5 drugs.

What you pay for your drugs will also vary depending on what phase of coverage.

Keep reading to learn more about the different phases of Part D coverage.

Coverage Phases

Part D coverage has four phases throughout the year:

- Annual deductible

- Initial coverage period

- Coverage gap (know as the ‘donut-hole’)

- Catastrophic coverage

The phases start over at the beginning of every year.

Let’s talk about each of these individual phases in more detail.

Annual Deductible

You will pay full price for your drugs’ costs during the annual deductible phase until you reach the yearly deductible amount if your plan has a deductible. Most plans do.

Initial Coverage Period

The initial coverage period begins once you have met your deductible.

If your plan does not have a deductible, the initial coverage period begins on January 1st or the first time during the year that you use your Part D plan.

During this phase, you pay your copays and coinsurance, and your plan pays the remainder of your drug costs.

You are in the initial coverage period until what you pay, and your plan pays for your drugs’ costs reaches a combined amount of $4,430 (in 2022).

Only the cost of your drugs goes toward that $4,430.

Costs that do not count include your monthly premium, as well as the prices for drugs not covered by the plan that you pay for entirely out-of-pocket.

Coverage Gap aka “The Donut Hole”

The coverage gap is also commonly referred to as the donut hole.

You reach the coverage gap or donut hole if you have gone through the initial coverage period.

You pay more for your drugs when you are in the coverage gap – a maximum of 25% (in 2022) of each drug’s cost.

You are in the coverage gap, or donut hole, until what you pay and what your plan pays moves from a combined amount of $4,430 (the amount that got you into the donut hole) to $7,050 (in 2022).

Catastrophic Coverage

You reach the catastrophic coverage phase once you are out of the coverage gap/donut hole.

During the catastrophic coverage phase, you pay only a small portion of your drugs’ costs for the rest of the year.

Here’s an example of the different coverage phases:

Janet has Part D prescription drug coverage and takes some expensive medications. She has met her deductible for the year.

What Janet pays in copays and coinsurance, plus what her plan pays for her drugs, reaches a combined total of $4,430 for the year.

She has now reached the coverage gap or donut hole, paying 25% of each of her drugs’ costs.

Once what Janet and her plan pay combined equals an additional $2,620 ($4,430 + $2,620 = $7,050), she will get out of the donut hole and into the catastrophic coverage phase, where she will pay a minimal amount for her drugs for the rest of the year.

Janet’s husband, Henry, is on the same Part D drug plan as Janet.

However, Henry is extremely healthy and does not take any prescription drugs.

Henry does not even meet the plan’s deductible, let alone go through the initial coverage, coverage gap, or catastrophic coverage phases.

Henry pays only his monthly premium to have the Part D drug plan should he need it.

Enrolling in Part D

There are certain times that you can enroll in a Part D prescription drug plan or switch Part D plans if you already have one, depending on your specific situation. Keep reading for more details on these enrollment periods.

Initial Enrollment Period (IEP)

A seven-month period that begins three months before the month in which you turn 65 includes the month in which you turn 65 and ends three months after the month in which you turn 65.

The first of the month in which you turn 65 is the earliest that Part D coverage can start.

If you enroll in a Part D plan the month in which you turn 65, in the three months after that month, coverage begins the first of the following month.

Suppose you are 64 or younger and receiving Social Security or Railroad Retirement Board (RRB) disability benefits. In that case, this seven-month period begins three months before the 25th month of receiving disability including the 25th month, and ends three months after the 25th month.

The first of the 25th month you receive benefits is the earliest that your Part D coverage can start.

If you enroll in a Part D plan on the 25th month you receive benefits, or any of the three months after that during this initial enrollment period, the coverage begins the first of the following month.

Annual Open Enrollment Period (AEP)

- October 15th -December 7th.

You can enroll in a Part D prescription drug plan or switch from one to another during this period.

If you enroll in a plan during this time, your coverage begins on January 1st of the coming year.

Medicare Advantage Open Enrollment Period (MA OEP)

- January 1st and March 31st.

During this period, individuals on Medicare Advantage plans can go back to Original Medicare Part A and Part B and enroll in a Part D drug plan.

Coverage begins the first of the month following the month you enroll.

Special Enrollment Periods (SEPs)

Typically, you’ll keep the Part D plan you have enrolled in from January 1st through the remainder of a calendar year.

Certain situations entitle you to a Special Enrollment Period that may allow you to enroll in or switch your plan mid-year. These include:

- Losing creditable drug coverage

- Moving

Losing Creditable Drug Coverage

Sometimes you or your spouse will continue to work beyond age 65. You will have a Special Enrollment Period to get a Part D plan if you will be losing medical insurance that includes drug coverage because of this.

You can enroll in a Part D drug plan as early as 60 days prior but no later than 60 days after losing your group coverage.

Moving

If you move out of your plan’s service area, you can switch to another Medicare Part D plan.

The service area is the geographical location of your plan services. If you move out of that area, your same Part D plan may not be available.

You can also switch to another Part D plan if you move within your plan’s service area. Typically new programs are available.

If you notify your plan that you are moving, you can switch plans one month before the month you are moving, the month you are moving, and the two months that follow.

If you wait until after you have moved to notify your plan, you can switch plans the month you tell them within the two months that follow.

How Do I Pick the Best Part D Drug Plan?

Picking a plan is easier than you think – sort of.

If you are not taking any medications, go with the lowest-cost plan.

It will cover you in the chance that you may need to start taking medications, or if you get sick and need something temporary.

If you are taking one or several medications, you’ll need to do a little research.

We will talk about picking a plan in a different article, but to summarize here’s what you do:

Get a list of your medications, go to Medicare’s website (or to your agent), and enter the dosages, quantities, amounts, and the pharmacy you go to.

Then pick a plan that covers all of your medications and has the lowest out-of-pocket cost.

Late Enrollment

Medicare can charge you a late enrollment penalty if you do not enroll in a Part D drug plan when you are first eligible for Medicare.

Your penalty depends on how many months you went without Part D drug coverage while you were eligible and did not have any other drug coverage.

The penalty is 1% of the average monthly premium of a Part D drug plan multiplied by the number of months you went without it.

The average monthly premium of a Part D plan is around $33 (in 2022).

Medicare changes the average premium from year to year. You can find the updated amount on Medicare’s website.

If you are subject to a late enrollment penalty, it is added to your Part D plan’s monthly premium indefinitely.

Let’s look at an example of a Late Enrollment Penalty:

Jane worked until she was 72. She chose not to enroll in a Part D plan when she retired because she did not take any prescriptions and thought it would make more sense to save the money.

Jane is now 74 and decides she would like to get a Part D drug plan if she does need to take any prescription medications in the future.

Jane must wait until October 7th during the annual open enrollment period to enroll in a drug plan. Her drug coverage will not begin until January 1st.

Jane will have been without a drug plan for 28 months by the time her Part D coverage begins.

At 1% of around $33 per month, her penalty is an extra $9.24 per month.

1% of $33 is $0.33.

$0.33 X 28 months is $9.24.

Let’s say Jane joins a Part D plan with a monthly premium of $30.

She will end up paying $39.24 per month with her late enrollment penalty.

Summary

As you can see, Part D plans add prescription drug coverage to your Original Medicare Part A and Part B health insurance.

Part D plans do not cover 100% of your prescription medication expenses but help minimize your out-of-pocket drug costs.

If you have any questions, use the search tool at the top of this page or on the home page.

Or, if you would like further explanation of any of the topics we discussed, please fill out a contact form and submit your questions.

If you prefer to speak by phone, call us at 888-209-5049.

Leave A Comment