You may be wondering what kind of help you can get with diabetes costs if you have Medicare or are going on Medicare for the first time.

If you have diabetes, Medicare pays for outpatient copays, doctor’s visits, preventative care, and lab work. After you meet your yearly deductible, Medicare pays 80% of approved costs. In addition to your medical bills, it will pay for prevention for pre-diabetics and self-management training.

20% of all Medicare beneficiaries have diabetes. So the need for help with costs and benefits is extremely high.

With the rising costs of healthcare, getting the right coverage is important now more than ever.

The good news is that if you are at high risk for or have diabetes, Medicare provides coverage for different kinds of supplies and services.

Medicare’s diabetes program helps with some of the following:

- Prevention and Preventative Care

- Self Management

- Supplies and Equipment

This article explains what programs are available through Medicare.

Prevention

If your doctor considers you to be at high risk for developing diabetes, Medicare Part B will cover two diabetic screenings per year.

Medicare Part B is outpatient medical coverage, which you can read about in more detail here.

These screenings include blood sugar and other lab tests.

Your healthcare provider will consider you high risk if you have high blood pressure, a history of high cholesterol or high blood sugar, or are overweight.

Having a family history of diabetes or having had diabetes during pregnancy could also be considered risk factors.

There is no cost for the screenings themselves. You won’t have to pay for anything.

If you do not have any coverage in addition to Medicare Part A and Part B, you could be responsible for 20% of the cost of the doctor’s office visit after you have met your yearly Part B deductible. Medicare Supplements and Medicare Advantage are the best way to lower your costs.

We talked about how deductibles are different on Medicare in more detail in a different post, which you can read here.

Medicare’s Diabetes Prevention Program

Medicare’s Diabetes Prevention Program is offered to Medicare beneficiaries once per lifetime and includes education and coaching focused on making healthy lifestyle changes.

You qualify for this program if you have never been diagnosed with diabetes, have high blood sugar levels, and have a high body mass index (BMI).

The program is six months long, is comprised of 16 group sessions with a behavioral coach, and includes:

- Nutrition, fitness, and weight loss tips and advice

- Support of fellow group members

- Training that is focused on making lasting lifestyle and behavior changes

You may be eligible for additional sessions and support if you successfully complete the program and maintain a healthy lifestyle.

If you meet the eligibility requirements, there is no cost to you for participating in this program.

Diabetes Self-Management Training

If you have diabetes, Medicare Part B offers training so that you can manage the disease at home versus in a doctor’s office setting.

Medicare Part B covers an initial ten hours of training and an additional two hours per year of follow-up training.

The focus of training is on healthy eating, being active, monitoring your blood sugar, and administering your own medications.

You must have an order from your healthcare provider to be eligible for the Diabetes Self-Management Training.

If you do not have any coverage in addition to Medicare Part A and Part B, you could be responsible for your annual Part B deductible as well as 20% of your costs after the deductible.

What Diabetic Supplies & Equipment are Covered by Medicare?

Medicare Part B covers durable medical equipment (DME), which are the supplies and equipment necessary for the management of diabetes and includes the following:

- Blood sugar testing supplies and equipment (test strips, monitors, fingersticks, etc.)

- Diabetic shoes and inserts

- Insulin pumps

You must have a prescription for durable medical equipment from your healthcare provider, and you must purchase the equipment from a supplier that accepts Medicare and Medicare assignments.

Accepting Medicare assignment means that a provider accepts Medicare-approved payment amounts as payment in full.

Part B will pick up 80% of the cost. You’ll be responsible for the rest unless you have a Supplement or Advantage Plan.

What Services Does Medicare Cover for Diabetics?

If you have diabetes, Medicare Part B will cover certain services that are necessary to check for certain conditions that people with diabetes are at higher risk for, including:

- One eye exam per year to check for diabetic retinopathy and glaucoma

- Nutrition therapy services focused on nutrition counseling and healthy lifestyle choices

- One blood sugar test every three months to monitor blood sugar levels

- One foot exam per year or more if you have diabetic neuropathy (nerve damage) or other conditions of the foot derived from diabetes

To be eligible for nutrition therapy services, your healthcare provider must write you a prescription.

There is no cost to you if you qualify for nutrition therapy services.

For all other services, you will be responsible for your annual Part B deductible and 20% of your costs after you have met your deductible if you do not have any coverage in addition to Medicare Part A and Part B.

How Much Does Part D Pay for Diabetes Medications?

Medicare Part D is prescription drug coverage.

You can purchase Part D plans through Medicare-approved private insurance companies.

We talked about Part D in more detail in another post, which you can read here.

Medicare Part D covers anti-diabetic drugs taken orally and insulin that is not administered through an insulin pump.

Insulin has historically been quite expensive, even with Part D prescription drug coverage.

Due to recent legislation, as of January 1, 2021, most insulin will be available for no more than $35 for a one-month supply with a Part D prescription drug plan, making it much more affordable than it has ever been.

Part D sometimes covers certain supplies, but for the most part, supplies are considered durable medical equipment and are covered under Part B as described above.

Costs to you could include any deductibles, copayments, or coinsurance amounts for prescription medications as dictated by the specific Part D plan you have.

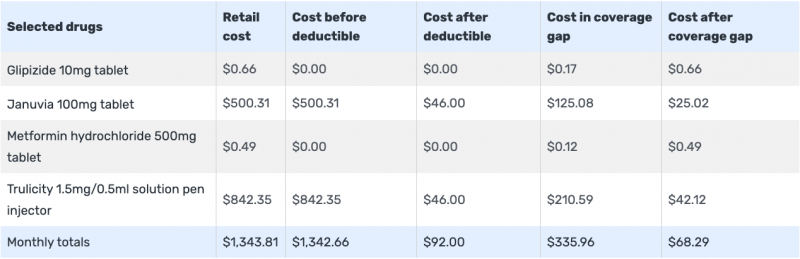

Here is an example of common diabetes medications:

Notice the copay, deductible, and coinsurance amounts.

Costs are based on:

- Zipcode

- Quantities

- Dosages

- The year that you are shopping

- If you do retail or mail order

If you are getting extra help, your costs may be lower.

Do Medicare Advantage Plans Cover Diabetes Supplies and Medications?

In short, yes!

Unlike traditional Medicare, Advantage Plans have their own specific costs for different equipment, supplies, and Medications.

Each plan is different and coverage amounts and limits are different.

When searching for a plan, just like for Part D, you want to enter all of your Medications to see what is covered at what amount.

Medicare Advantage plans, also commonly known as Part C of Medicare, are plans sold by Medicare-approved private insurance companies to cover all of your Part A and Part B services.

Advantage plans usually include prescription drug coverage and sometimes other benefits not covered by Medicare, like dental, vision, and hearing.

We talked about Part C in more detail in another post, which you can read here.

What Extra Help is Available Through Medicare Advantage Plans for Diabetics?

If you have a chronic condition like diabetes, you could be eligible to enroll in a special type of Medicare Advantage plan called a Chronic Condition Special Needs Plan (C-SNP), if there is one available in your area.

A Special Needs Plan covers specific services and prescriptions and includes healthcare providers in the plan’s network that cater to patients with a particular condition.

If you have diabetes, there may be a Special Needs Plan available in your area that is a good fit for you and your healthcare needs. You can call Medicare (1-800-633-4227) to see if you are eligible.

Medigap

Medicare supplement plans, also commonly known as Medigap plans, are plans you can purchase in addition to Part A and Part B to help minimize your out-of-pocket expenses on Medicare.

We talked about Medigap plans in more detail in another post, which you can read here.

There are several different Medigap plans you can purchase that provide different levels of coverage.

While most Medigap plans do not cover your annual Part B deductible, most cover the other 20% of medical costs you can be responsible for, such as diabetic screenings, services, supplies, and equipment.

The annual Part B deductible is $233 (in 2022). Remember this amount always changes. See the new amount here.

Your annual deductible is the first $233 of outpatient medical expenses each year you must pay before Medicare pays.

Medicare Part B pays for 80% of your outpatient medical expenses after you have met your deductible.

If you have only Medicare Part A and Part B, you are responsible for the other 20%.

Most Medigap plans pick up some, if not all, of the other 20%.

It is important to note that Medigap plans do not cover prescription medications.

Summary

Many seniors on Medicare have diabetes or are at high risk for developing diabetes.

Medicare Part B helps to cover preventive services for those at high risk.

If you have diabetes, Medicare Part B helps cover screenings, services, supplies, and equipment necessary for managing the disease.

Medicare Part D helps to cover insulin and anti-diabetic medications.

There may be Medicare Advantage plans designed specifically for people with diabetes available to you in your area.

A Medigap plan can help pay for any out-of-pocket expenses you may be responsible for after Medicare pays.

If you have any questions, use the search tool at the top of this page or on the home page.

Or, if you would like further detail on any of the topics we discussed, please fill out a contact form and submit your question.

If you prefer to speak by phone, call us at 888-209-5049.

Leave A Comment