You’re probably wondering if you’ll have to pay a copay when you use your coverage.

Generally speaking, yes. Being on Medicare, you’ll have to pay a portion of your medical expenses. In addition to copays, you’ll pay for deductibles, coinsurance, and gaps in coverage. The program you choose will determine how much you’ll have to pay.

The answer to this question depends on what part of Medicare you are talking about.

Today we will talk about how copays work with the different parts of Medicare.

The Basics of Medicare

Medicare is broken down into several different parts and depending on what part you are using, you’ll pay a copay in some form or fashion.

The 4 Parts of Medicare are:

- A – Hospital coverage

- B – Medical outpatient coverage

- C – Medicare Advantage

- D – Prescription drug coverage

In addition to these 4 major parts, Medicare Supplements also play a role in determining what your copay may be.

Supplement Plans are optional benefits you can purchase to help with some of your out-of-pocket while being on Medicare. You can read more about them here.

People often ask what their copay is to get a general understanding of what is covered while being on Medicare.

What is a Copay?

A copay is a set dollar amount that you must pay when you see a provider.

Medicare requires you to pay copayments for some services, but not all.

If you have any coverage in addition to Medicare, your plan determines if you’ll have any copays.

Usually, you would pick a plan based on how much it costs and what your out-of-pocket would be (i.e. the amount of a copay).

Continue reading to find out more about copays on each part of Medicare.

How Do Medicare Copays Differ from Traditional Insurance?

Regardless if it was through an employer, a private plan, a plan through your own business, or if you’ve had coverage through a spouse – a copay was, just, a copay.

It was a set amount we paid when we saw a doctor, specialist, or if we needed to get a prescription filled.

We knew ahead of time what it would be so there were no surprises when we needed to see a provider.

The difference with Medicare is how these copays are billed and when you will pay for them.

So, regardless of what Medicare calls it, remember that you’ll still have to pay a portion of your bills. The only difference is when.

The bottom of this article will cover when you’ll pay your copays with Medicare. Keep reading to learn more.

Medicare Part A and Copays

Medicare Part A is inpatient hospital coverage.

It covers things like:

- Inpatient care in a hospital

- Skilled nursing facility care

- Nursing home care

- Hospice care

- Home health care

As you read above, a copay is a set amount for a specific procedure.

Where it gets interesting, is that even though Part A does have a set amount you would pay while being in the hospital, they do not call this a copay. In Part A, this is known as coinsurance.

Part A and Hospice

There are several copays that you’ll have to pay if you decide to go into hospice care.

When someone is nearing the end of their life, they may not want to not continue treatment to cure their illness, but instead, placed in hospice and made comfortable. Usually, someone who has less than 6 months to live.

Hospice is done in someone’s home or in a nursing facility. It’s only purposed to better someone’s last days of living.

When receiving hospice care, you’ll usually pay a small copay for medications that are used. They can only be used for pain relief or maybe to control symptoms, and not used to cure or treat the illness. The amount is generally only $5.

An agreement needs to be signed to say that they are ok with stopping all treatment when they are placed in hospice.

If someone has a friend or family member taking care of them while they are in hospice, they may pay a 5% copay for respite care.

Respite care allows a caregiver to take some time off, and instead, a licensed professional takes over the duties of a caregiver. Usually, just for a small period of time

Medicare Part B and Copays

Medicare Part B is outpatient medical coverage. We talked more about Part B in a different post. Click here to read.

Generally speaking, Part B pays 80% for outpatient services after you meet a deductible.

There are many instances when you will not have a copay for outpatient services. Meaning you won’t pay when you go, but instead, be billed at a later date.

You’ll still have to pay the charge, just not right away. You can work this out with your doctor.

However, your provider may want to collect this amount during your visit in the form of a copay.

**Notice that the coinsurance was called a copay when the time it was collected changed.**

We will cover how Part B copays are billed later in this article.

Medicare Part B Covers a Wide Variety of Outpatient Medical Services

These include:

- Receiving blood

- Rehab after a heart attack or other cardiac event

- Chemotherapy

- Certain surgeries (polyp or tissue removal after a colonoscopy, implantation of a cardiac defibrillator)

- Specific procedures (EKG, certain colorectal procedures)

- Emergency room visits

- Foot exams & treatment

- Blood sugar tests

- Hearing exams

Providers may require you to pay a copay at the time of the service. The copay will never be more than 20% of the bill.

If you have additional coverage, like a Medicare Advantage Plan or a Medicare Supplement, you could have copays for outpatient services. However, each separate procedure and visit will have a more, predetermined, set amount, instead of being 20% of the bill.

Keep reading to learn more about copays when you have additional coverage to Medicare.

Medicare Supplement and Copays

Medicare Supplement Plans, often referred to as Medigap plans, help cover the additional expenses you would otherwise be paying entirely out-of-pocket if you had only Medicare Part A and Part B.

These plans work with Medicare Part A and Part B, and we will discuss them further in a different post, here.

There are several Supplement Plans to choose from, depending on which one suits your needs.

All these plans cover the Part A hospice copay in full, and most cover any Part B copays in full.

Here are a few exceptions:

- Plan K – covers 50% of Part B copays

- Plan L – covers 7% of Part B copays

- Plan N – requires you to pay 20% of a doctor’s visit with a maximum of $20, and no more than $50 for emergency room visits. This coinsurance amount is billed in the form of a copay.

Let’s use an example of how copays work when you have a Supplement:

Lucille has Supplemental Plan N in addition to Medicare Part A and Part B.

She has already met her Part B deductible for the year. We talked about deductibles in a different post – click here to read.

Recently, she went to her doctor who recommended she see her cardiologist, which she did a few days later.

Lucille paid a $20 copay to her doctor and a $20 copay to her cardiologist at the time of her visit.

Her Plan N and Medicare cover the rest of her bills.

Medicare Advantage and Copays

Medicare Advantage Plans are an alternative to Medicare.

These plans cover all your Part A and Part B expenses, and most include Part D prescription drug coverage as well. Some plans provide additional benefits that may not be included with Original Medicare, like dental coverage.

We talked more about Medicare Advantage here.

Most Advantage Plans are made up of copays.

One plan may have a no copay for primary care doctors and a $35 copay for specialists, while another has a $20 copay for primary care doctors and a $50 copay for specialists.

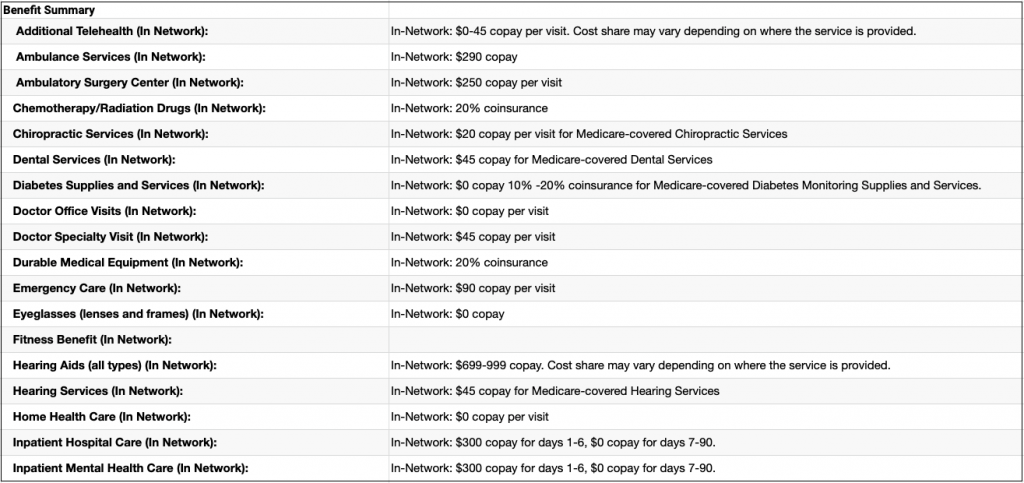

Here is an example of what that might look like:

It is important to look at the coverage details on Advantage Plans very closely. They vary widely from one plan to the next.

For example, you can still have other out-of-pocket expenses, such as higher deductibles, even when choosing a plan with less expensive copays.

Part D and Copays

Medicare Part D is prescription drug coverage.

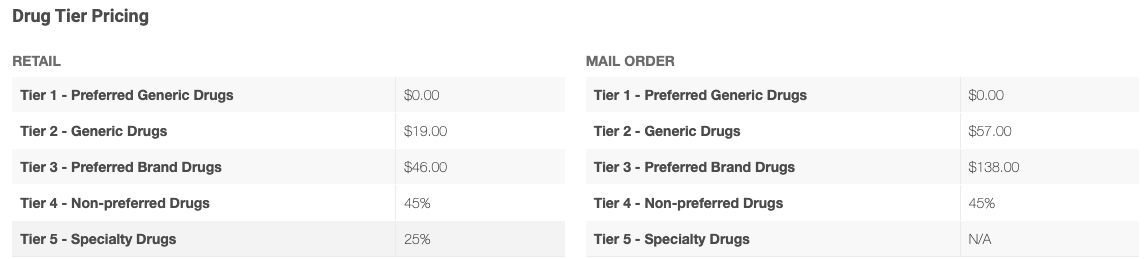

Prescription drugs on a Part D plan have different levels called tiers. Each tier has its own copay.

Plan structures usually include Tiers 1-5, with less expensive or no-cost drugs classified as Tier 1 drugs. More expensive, specialized drugs fall into higher tiers.

Here is an example:

Each of your drug’s copay amounts may change based on what coverage phase you are in. Sometimes the amount you pay is no longer a copay (as set amount) but a percentage of the cost (coinsurance). The plan you pick and the pharmacy you use all play a part in what a copay can be.

Here’s what that looks like:

Coverage Phases are covered here.

As you saw above:

- Tier 1 includes preferred generic drugs with either a very minimal copay or maybe even no copay.

- Tier 2 includes generic drugs with usually a slightly higher copay than Tier 1.

- Tier 3 drugs include brand-name drugs, and copays are usually in the $35-$50 range.

- Tier 4 and Tier 5 drugs are more specialized and have a coinsurance instead of a copayment.

Part D copays and plans can vary widely from one to the next. It is important to look very closely at the details to determine which plan best suits your prescription needs.

Let’s look at an example of copays on Part D:

Janet has the Smart Senior Part D plan. She takes a Tier 1 drug, a Tier 2 drug, and a Tier 3 drug.

Every time she gets them filled, she pays a

- $0 copay for her Tier 1 drug

- $19 copay for her Tier 2 drug

- $46 copay for her Tier 3 drug

Her friend Doug takes exactly the same medications she does but is on a different plan. He wanted to get the same plan Janet has but because he lives in a different state, he chose a plan that was available in his area.

When he gets his medications, he will pay:

- $1 copay for his Tier 1 drug

- $8 copay for his Tier 2 drug

- $43 copay for his Tier 3 drug

Notice that the amounts they pay for their drugs are very different because of the plan they are on.

This is something that happens very frequently.

Rember, when buying a drug plan, work with an agent who will look at all the plans in your area. This way you’ll get the best coverage.

Here is an article that talks about how to pick an agent.

When Do I Pay My Medicare Copay?

As you’ve seen from the examples above, it’s very rare that you won’t have some kind of charge for your medical needs.

In most cases, your providers will send a bill to Medicare for your services and then sends it to your Supplement. If you owe anything, the rest gets billed to you. Almost all coinsurance works this way.

If you have a copay, you’ll usually pay it at the time of your visit. It is very rare to see the amount change.

Advantage Plan copays work a little differently. The amount you pay and when you pay is determined by your provider. In almost every instance, you’ll need to get a preapproval before you can have treatment.

Once you have the preapproval, your provider will usually tell you when you own and when you’ll pay. If you have to pay during the time of your visit, they will let you know.

Here’s an example:

I remember growing up, my grandmother would always take me to her doctor’s appointments.

We are from a different country and when we first moved here she had a hard time speaking English. I would be the one to translate.

She had an Advantage Plan that she really liked but she would always have me ask how much she would have to pay when she went to the doctor.

I remember having to call and ask so she knew how much cash she needed to bring.

She was having issues with her thyroid and one day she needed to have it removed.

Once the doctor got the pre-approval from the insurance company, he was able to tell us how much she had to pay once she finally had her procedure.

The only thing she ever had to pay was a small copay for her procedures.

Now, if she had original Medicare, the amount that would be billed would be coinsurance. Since she would have to pay a percentage of the cost vs. a preset dollar amount.

What if I Can’t Afford My Out-of-Pocket Costs on Medicare?

If you cannot afford the out-of-pocket costs, you can apply for help.

There are different programs available that you can look into. These programs are based on your income and net worth.

I wrote an article that talks about these programs and how to apply here.

It never hurts to look into what your options are.

Summary

Many of the different terms used when talking about Medicare can be confusing and are often used interchangeably.

Just remember to talk to your provider, it is important to ask what your charges will be so there are no surprises.

As you see, there are several different ways you can be billed for your procedure. Most plans have a very straightforward outline that summarizes all your costs.

If you have any questions, please reach out! You can use the contact form or the chat button to ask any questions you may have.

If you prefer to speak by phone, call us at 888-209-5049.

Leave A Comment