This is very common, and the question comes up all the time.

The easiest way to lower your Medicare Advantage out-of-pocket costs is to add additional benefits such as ancillary policies and indemnity policies. Secondary benefits that provide coverage to help lower deductibles, copays, and coinsurance. Every Medicare Advantage Plan will have at least some kind of gap in coverage that you’ll need help paying.

You joined a Medicare Advantage Plan. After being on it a few years, you’ve had to use it a few times.

Or, maybe you have yet to use it, but finally, read your summary of benefits.

You realize that, although the monthly premiums are low, the copays and out-of-pocket are just more than what you can afford.

Today we will talk about what you can do to lower your out-of-pocket while being on Medicare Advantage.

What Are My Health Insurance Options While Being on Medicare?

Remember, Medicare Advantage is not your only option.

When it comes to minimizing out-of-pocket expenses, you can add a Supplement Plan to original Medicare (Part A & Part B) or join a Medicare Advantage Plan.

You can’t have both.

Medicare Supplements typically offer lower medical costs than Medicare Advantage.

But they are generally more expensive.

In contrast, Medicare Advantage Plans have little to no monthly premiums but can have very high out-of-pocket expenses.

Usually, though, you use medical services when you generally find out your true expenses.

You can read more about Medicare Supplements here.

But what can you do if a Medicare Supplement Plan isn’t in your budget?

Or if you cannot qualify for a Medicare Supplement.

Read more about qualifying for Medicare Supplements here.

What Are My Medicare Advantage Out-of-Pocket Costs?

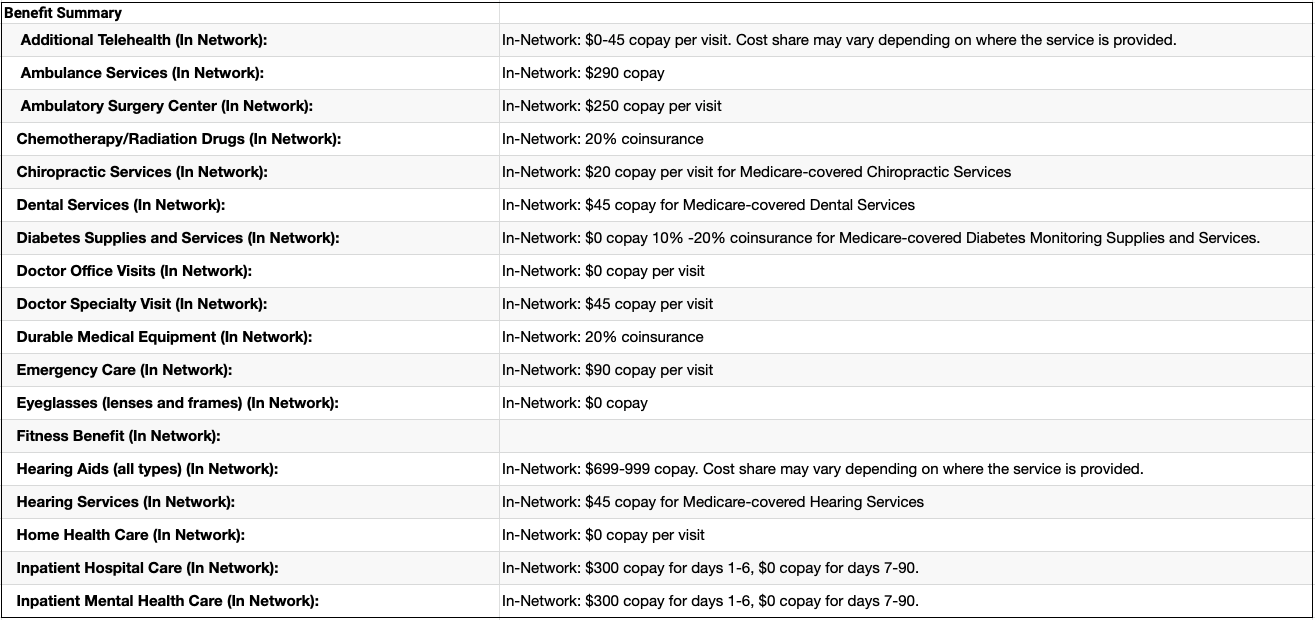

First, let’s look at all the different out-of-pocket medical expenses you may have when being on Advantage.

You can read more details here, but for the sake of this article, we will touch on them briefly:

Copays

Usually, being on Medicare Advantage, you’ll have a copay for just about everything.

- Doctor visits

- Specialists

- X-rays

- CT Scans

- MRI’s

- Daily hospital stays

Let’s look at hospital stays as an example:

Mrs. Suzy has a Medicare Advantage Plan that she’s been on for 3 years.

She’s in great health and rarely goes to the doctor.

Typically, she will see a specialist once a year to get a Well-Woman’s exam.

She also sees her primary doctor and gets her blood pressure prescription refilled.

She lives in Pennsylvania.

One winter morning, she went outside and slipped on a patch of ice and hurt her hip.

On her way down, she hit her head.

Her neighbor finds her and calls an ambulance where they take her to the Emergency Room.

She spends 3 days in the hospital while her swelling goes down.

Once her exams come back, the doctor noticed a spot on her skin. Doing some more testing, they find that she has Melanoma.

Here are some of the costs that Mrs. Suzy is going to face:

- Ambulance ride

- 3 Day hospital stay

- MRI

- X-ray

- Surgery

- Cancer Treatment

Each one of those services will have its own price.

She will have to pay a copay for most of those services.

Coinsurance

Sometimes, instead of a copay, a Medicare Advantage company will list a procedure or service price as coinsurance.

A copay is a set price, while coinsurance is a percentage of the charge.

So for Mrs. Suzy, according to her summary of benefits, some of the charges listed above will pay a percentage.

For her Cancer treatment, for example, she might pay up to 20% of the charges.

Here is an example of some of the services you can be billed for on a Medicare Advantage Plan:

What Are My Options for Lowering My Medicare Out-Of-Pocket Costs?

The good news is that there is more than one way to lower your medical bills.

You can purchase additional coverage, such as:

- Hospital Indemnity Plans

- Cancer Insurance

- Heart Attack or Stroke

Let’s talk about each one of these individually.

Don’t worry!

If you cannot afford additional coverage, we will talk about ways to apply for extra help.

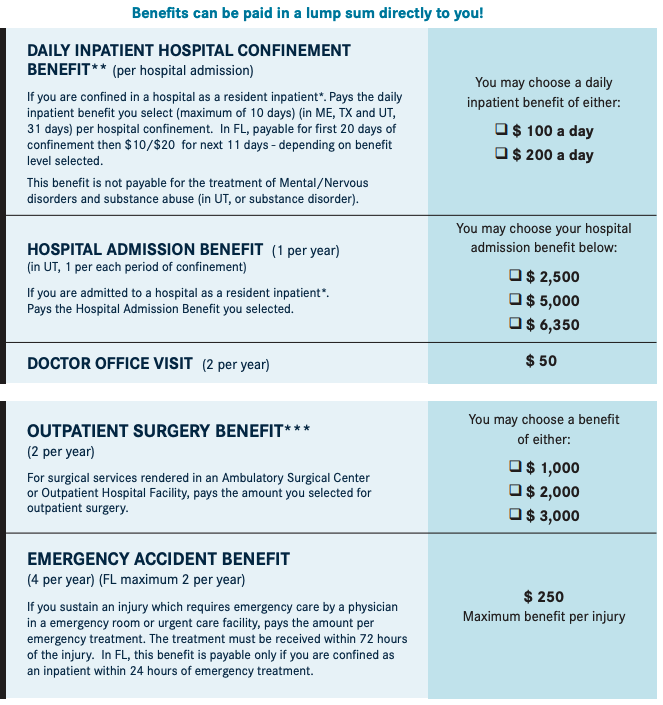

Hospital Indemnity Plans

If you have a Medicare Advantage Plan, you will likely have very expensive copays associated with hospitalizations.

For example, on some Advantage Plans, you may be responsible for $300 per day for the first eight days of an inpatient hospital admission (See image above).

A hospital indemnity plan, in addition to your Advantage Plan to help with unexpected expenses like the one mentioned in the example above.

Hospital Indemnity Plans pay a set dollar amount per day for each day you are in the hospital or for different types of hospital visits. The amount of the benefit is paid directly to you.

For example, a Hospital Indemnity Plan might be structured as follows:

- $200 for an emergency room visit

- $1,500 for an inpatient hospital admission

- $10,000 for a three-night stay in the hospital

- $1,500 per day for hospital admission.

Here is an example of one of the carriers we represent. In this example, this policy is only $18.00 per month:

You can use the benefit amount to help minimize your out-of-pocket expenses.

Monthly premium prices for a hospital indemnity plan vary according to age, gender, tobacco use, and of course, how much coverage you purchase, but for someone who is 65, monthly premiums might cost around $20-$30 per month.

Hospital Indemnity Plans pay the predetermined amount described in your policy regardless of any additional coverage you have.

Because Advantage Plans leave you exposed to some pretty major out-of-pocket medical expenses if you have an out-of-pocket, it might be a good idea to purchase a Hospital Indemnity Plan in addition to the Advantage Plan you have now.

Working with a good broker, remember to ask about these additional benefits.

You can read here on the best way to pick an agent to work with.

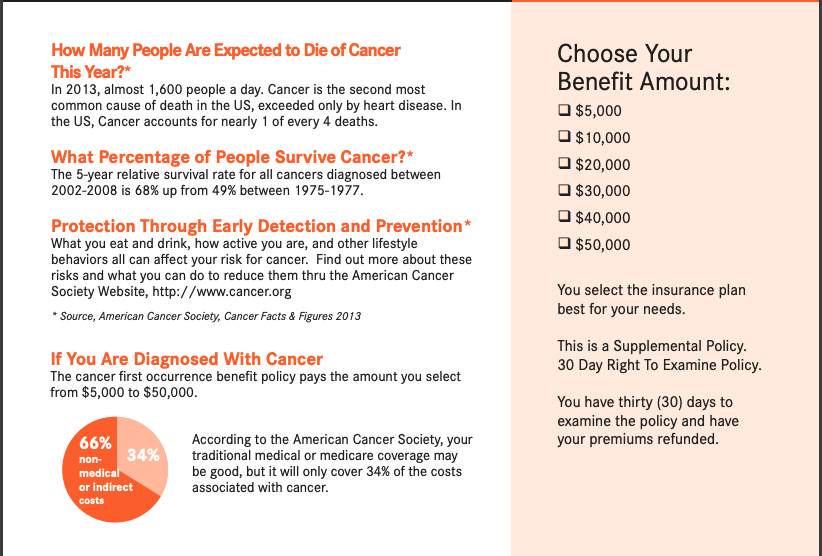

Cancer Insurance

Medicare Advantage Plans do not typically provide the best coverage for cancer patients.

Advantage Plans require you to receive treatment from providers in the plan’s network, and you can have much higher out-of-pocket expenses if you go out-of-network.

In the example above, you’d be responsible for 19% of the cancer costs.

With most Advantage Plans, the average you might be responsible for is about 20% of your cancer treatment.

Treatment such as chemotherapy, radiation, and cancer drugs you receive in the doctor’s office are all very expensive.

Having to pay a percentage of the total bill for these services can add up quickly.

Most Advantage Plans have a yearly out-of-pocket maximum.

Usually, around $6,700 for in-network or $10,000 for in- and out-of-network is the average.

If you have cancer and are on an Advantage Plan, you could meet your yearly out-of-pocket maximum quickly – almost immediately.

Cancer insurance is an affordable benefit you can purchase in addition to your Advantage Plan to help mitigate the very high medical expenses you can incur if you develop cancer.

Some cancer insurance policies pay a set lump sum benefit if you receive a cancer diagnosis.

What do Cancer Plans Pay For?

The lump amount can help pay for:

- copays

- deductibles

- income replacement

- travel expenses

- other treatment costs not covered by your Advantage Plan.

Other cancer insurance policies will pay a percentage of specific treatments like care provided in a hospital or doctor’s office setting, lab work, procedures, surgeries, and drugs.

Lump-sum benefits are cost-effective and more popular because you can spend the money paid to you how you choose, and you do not have to show that you are spending it on treatment.

Monthly premium prices for a lump-sum cancer benefit vary according to age, gender, tobacco use, and of course, how much coverage you purchase, but for someone who is 65, monthly premiums for a $10,000 policy might cost around $25.

Here is an example:

Heart Attack or Stroke Insurance

Most heart attack and stroke policies are combined into one and work similarly to cancer insurance, paying you if you have a heart attack or stroke.

These plans are affordable and can be invaluable when you are in a Medicare Advantage Plan, as hospitalizations alone for these conditions can be incredibly costly.

Most of these plans are lump sum benefits that pay a set dollar amount when you receive a heart attack or stroke diagnosis.

Very similar to a cancer plan.

Just like the cancer plan, the money is yours to spend how you see fit.

Monthly premiums for a heart attack or stroke benefit vary according to age, gender, tobacco use, the amount of coverage you purchase and are priced similarly to cancer insurance policies.

What if You Can’t Afford Any Additional Premium?

Sometimes, even $10 extra in premium is just too much.

Everyone’s situation is different.

Although additional benefits are almost always recommended, sometimes there is only so much we can afford.

The good news, for low-income households, you may qualify for different subsidies that can help you with your out-of-pocket costs.

Some programs can help you with:

- prescription costs

- deductibles

- copays

- coinsurance

- Part B premiums

You can read about these programs here.

If you can barely afford your medical costs, I highly recommend applying for extra help.

The worst thing you can do is nothing.

Summary

Many people on Medicare will either purchase a supplement plan or join an Advantage Plan to minimize their out-of-pocket medical expenses.

Medicare supplements leave you with little to no out-of-pocket medical expenses after you pay your monthly premiums.

Medicare Advantage Plans have little to no monthly premiums but usually have relatively high maximum yearly out-of-pocket expenses.

If a Medicare supplement is not in the budget, there are affordable policies you can purchase to help optimize your Medicare Advantage coverage.

If you join a Medicare Advantage Plan, it is advisable to purchase a hospital indemnity plan, a cancer plan, a heart attack, and stroke plan, or some combination of all three.

The best thing you can do is contact an independent agent who will help you find affordable critical illness benefits that can help fill in the coverage gaps you can have on an Advantage Plan.

If you have any questions, use the search tool at the top of this page or on the home page.

Or, if you would like further detail on any of the topics we discussed, please fill out a contact form and submit your question.

If you prefer to speak by phone, call us at 888-209-5049.

Leave A Comment