Like many on Medicare, you are probably wondering what the Medicare “Donut Hole” is and why there is this gap in coverage.

The term “donut hole” refers to the point at which you and your Part D prescription plan have reached a limit on what will be covered for drugs (also known as the “Coverage Gap”). This means that the drug plan’s coverage for medications is temporarily limited, making you liable for 25% of the expenses for your covered prescriptions during this period.

Let’s break it down further.

What is Medicare Part D?

Medicare Part D is a program that helps pay for your prescription drug coverage.

If you are enrolled in Original Medicare, Part D plans are offered through Medicare-approved private companies.

Your Part D drug plan will pay for drugs not covered by Part A and Part B (Original Medicare).

So, if you have Medicare Part A and Part B, you can enroll in a Part D plan to add prescription drug coverage.

If you have a Medicare Advantage Plan, however, this set of benefits will likely be included. If it is not, you can enroll in a separate Part D prescription drug plan.

Be careful – some Medicare Advantage Plans may not let you get a separate drug plan.

Interested in learning about the 4 parts to Medicare? Check out these links:

What Happens When I Reach the “Donut Hole?”

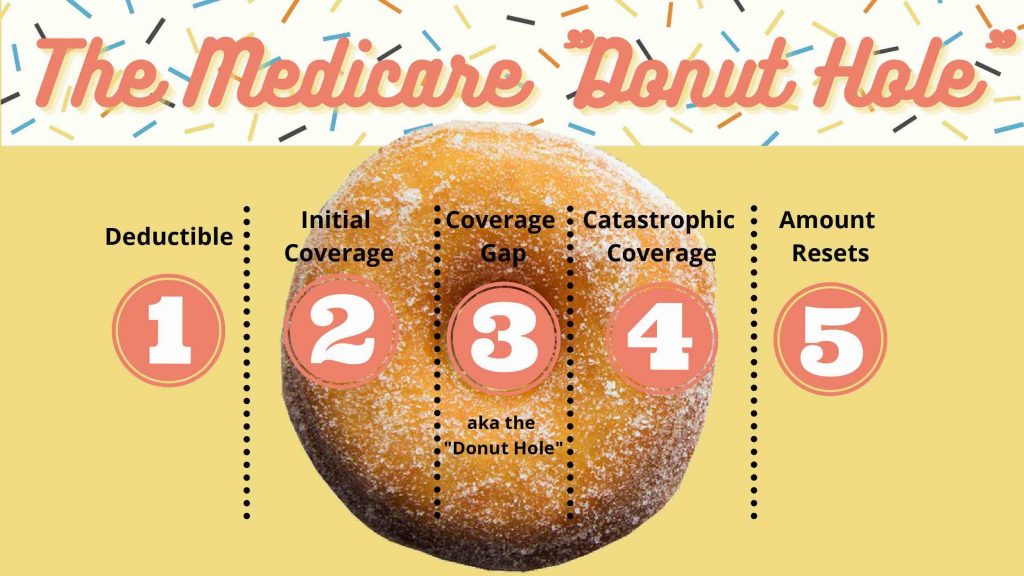

The “donut hole” is the third (of four) payment stages within Medicare Part D.

Most Part D plans and Advantage Plans will have this coverage gap.

When the total overall drug costs—including what you and your plan have spent for your medications you enter the “donut hole.”

You are then responsible for 25% of the cost of your drugs while you are in the coverage gap (aka donut hole).

Not everyone will cross this threshold into the “donut hole.” If you have basic generic medications, chances are, you won’t end up in the donut hole.

If you have Medicare and receive “Extra Help”, you will never enter this coverage gap. Learn more about the “Extra Help” program here.

Keep in mind, what you pay will be different for name-brand vs generic.

What Are the Payment Stages of Part D Drug Plans?

You are probably wondering what these payment stages even mean.

Let’s take a look:

- Stage 1 (Deductible) – You pay 100% of your prescription drug costs until you reach your yearly deductible ($445 for 2021, see the most up-to-date figure here). Once you have reached this threshold, you will move to stage 2. Not all medications make you pay the deductible.

- Stage 2 (Initial Coverage) – You pay a set copay for your prescription drugs. After you and your plan have spent a certain amount ($4,130 in 2021), you enter stage 3 (see the most up-to-date figure here).

- Stage 3 (Coverage Gap aka the “Donut Hole”) – You pay no more than 25% of the cost of the drug. After you reach the total out-of-pocket on your drug (see the most up-to-date figure here), you enter stage 4.

- Stage 4 (Catastrophic Coverage) – You pay a small coinsurance percentage or copayment for covered prescriptions for the remainder of the calendar year. The remainder of the medication is paid for by the pharmaceutical company.

Let’s go further and elaborate on each stage.

Stage 1 (Deductible)

You will pay the full negotiated price for your covered prescription medications until you satisfy your Part D deductible. In 2021, that figure is $445 (as we’ve mentioned before, find the most up-to-date figure here).

Once you’ve satisfied your deductible, the plan will start paying for your prescriptions.

While deductibles vary by plan, no deductible can be more than $445 in 2021. This figure may change from year to year.

Not all medications will require you to meet the deductible before you have coverage.

Stage 2 (Initial Coverage)

Your plan will assist in paying for your covered prescriptions once you have met your deductible.

Some plans don’t have a deductible at all while others may have a deductible but don’t make you meet it for certain medications (usually tier 1 and tier 2).

Your Part D drug plan will cover a portion of the cost, while you will be responsible for a preset copayment or coinsurance.

How long you stay in this stage will be determined by your drug costs and the benefit structure of your plan.

Stage 3 (Coverage Gap aka the “Donut Hole”)

You enter the coverage gap, commonly known as the “donut hole” when the total prescription expenditures surpass $4,130 (up-to-date amount here). This is a combination of what you pay and what the insurance company pays – the total price of the drug.

In 2020, the donut hole for all drugs partly went away, which means that when you reach the coverage gap, you will be liable for 25% of the cost of your medications (in previous years, you were liable for a larger portion of the cost of your medications).

Remember, not everyone will enter into the “Donut Hole.”

Stage 4 (Catastrophic Coverage)

Once your out-of-pocket costs have reached $6,550, you have entered into Catastrophic Coverage (up-to-date amount here).

Out-of-pocket costs include:

- Copays and your coinsurance payments

- Your annual deductible

- Any drugs your Part D drug plan pays for in the initial coverage stage

- Manufacturer’s discounts included in the coverage gap stage

- Any amounts paid by others on your behalf, such as financial assistance programs, in any payment stage

During the catastrophic coverage phase, you pay only a small portion of your drugs’ costs for the rest of the year.

What if I Can’t Afford the Cost of My Medications?

Remember, Medicare Part D plans are purchased from Medicare-approved private insurance companies to help cover your prescription medication costs.

The “Extra Help” program can help pay for Part D prescription drug costs if you have limited income and resources.

The Extra Help program can assist in paying for some or all of:

- Part D plan monthly premiums

- Deductibles

- Copayments or coinsurance

There are different levels of “Extra Help” you may qualify for depending on your income and resources. You can find out your level of “Extra Help” here.

For individuals, your yearly income must not exceed $19,320 (in 2021), and your resources must not exceed $14,790 (again, in 2021).

For married couples, your yearly income must not exceed $26,130 (in 2021), and your resources must not exceed $29,520 (again, in 2021).

These figures vary year-to-year, to see the updated amounts – click here.

If you think you fall under any of the above conditions, you can apply for Extra Help here.

The “Donut Hole” and Medicare Advantage

Most Medicare Advantage Plans also offer prescription drug coverage, but not all will.

Advantage plans follow the same rules as traditional Part D drug plans when it comes to the “donut hole.”

Medicare Advantage Plans (often called Part C of Medicare) are offered by private companies that contract with Medicare.

These plans offer you benefits as an alternative to Original Medicare.

Advantage plans provide all of your Part A (hospital) and Part B (medical) benefits. It will help pay for things like major hospital stays, doctor’s visits, preventative care, lab work, meal delivery services, and dental.

You’ll need to make sure you are careful about which plan you are choosing. It is important to find a plan that covers all of your doctors and prescriptions.

If you choose an Advantage plan that does not include prescription drug coverage, you may not be able to apply for a separate Part D plan.

There are only a few types of Advantage plans that allow you to have a separate drug plan:

- Medicare Medical Savings Account (these cannot offer drug benefits).

- Private Fee-for-Service (some of these may choose not to offer drug coverage).

You can search for an Advantage Plan or Part D drug plan by clicking here

Customize your search by entering your:

- Zip Code

- County you live in

- Pharmacy

- Doctors

- Specialists

- Current Medication

You can learn more about Medicare Advantage Plans here.

Generic Prescriptions

The coverage for generic medications differs from name-brand.

You will pay 25% of the cost of generic medications, while Medicare will cover the remaining 75%.

Only the amount that you pay (25%) will count towards your out-of-pocket spending.

Example for Generic Drugs:

Mr. Collins reaches the “donut hole” in his Part D drug plan. He goes to his local pharmacy to fill a prescription for a generic drug that is covered under his plan.

The price for the drug is $50, and there is a $2 dispensing fee (so in total, $52).

Mr. Collins will pay 25% of the plan’s cost for the prescription and dispensing fee ($52 x .25 = $13).

The $13 that he will pay goes towards his out-of-pocket costs.

Keep reading to learn about name-brand prescriptions.

Name-Brand Prescriptions

During this time you will be responsible for no more than 25% of the cost of your name-brand prescription medications.

You will also be responsible for 25% of the dispensing fee.

If you pay for your medications at a pharmacy or by mail order, you will be eligible for this discount.

While you’re in the coverage gap, some plans may even give you cheaper monthly costs.

With that being said, the entire cost of your name-brand medications will be applied to out-of-pocket expenses to assist you with escaping the “donut hole.”

Though you will pay no more than 25% of the price for the name-brand drug, 95% of the cost of the drug will count towards your out-of-pocket spending.

Here’s how it works:

- The manufacturer pays 70% of the total cost of the drug. Your Part D drug plan then covers 5% of the cost (so, in total 75% by both the manufacturer and your plan). You are responsible for the remaining 25% of the drug’s cost.

- There’s also a cost for dispensing. 75% of the fee is paid by your plan, and 25% is paid by you.

Example for Name-Brand Drugs:

Mrs. Gupta reaches Stage 3, the coverage gap in her Medicare Part D drug plan. She goes to her local pharmacy to fill a prescription for a name-brand medication that is covered by her plan.

The price of the drug is $90 and there is a $2 dispensing fee, making the total cost $92. Mrs. Gupta pays 25% of the total cost ($92 x .25 = $23).

The amount that Mrs. Gupta pays ($23) plus the manufacturer discount payment ($90 x .70 = $63) counts as out-of-pocket spending.

So, $86 counts as out-of-pocket spending and helps Mrs. Gupta get out of the “donut hole.”

The remaining $6, which is 5% of the drug cost ($4.50) and 75% of the dispensing fee ($1.50) paid by the drug plan, does not count towards Mrs. Gupta’s out-of-pocket spending.

When Does the Donut Hole End?

In order to get out of the “donut hole”, your total out-of-pocket costs must reach $6,550 in 2021 (click here for the most up-to-date figure).

If you reach this figure, you then enter into “Catastrophic Coverage” which is the last payment stage.

Out of pocket costs include:

- Your copays, coinsurance payments, and a yearly deductible

- What your Part D drug plan pays for drugs in the initial coverage stage (2nd payments stage)

- Any discounts provided by drug manufacturers during the coverage gap stage (3rd payment stage)

- Any amounts paid by others on your behalf, such as financial assistance programs, in any payment stage

Out of pocket costs do not include:

- The drug plan premium

- Pharmacy dispensing fees

- Payments for drugs that are not covered

Will the Donut Hole Ever Go Away?

The Part D drug plan had a coverage gap when it was first implemented in 2006.

This meant that prescription plans did not cover the full cost of prescriptions within the donut hole, and beneficiaries were left to bear the cost.

In 2011, the Affordable Care Act (ACA) took measures to close the “donut hole.”

The ACA then offered discounts for this coverage gap a year later in 2012.

Fast forward to 2019, these discounts meant that beneficiaries paid 25% of the cost for any brand-name medications (and 37% for generics) officially closing the donut hole as of January 1st, 2020.

Many people are under the assumption that once they reach this payment stage, they will no longer have to pay for prescriptions.

However, this is not the case.

Summary

The Medicare “donut hole” refers to the 3rd payment stage of Part D drug plans.

To reach this stage, you and your Part D drug plan must have spent $4,130 in 2021.

Keep in mind, not everyone will not enter this coverage gap.

If you have any questions, use the search tool at the top of this page or on the home page.

Or, if you would like further detail on any of the topics we discussed, please fill out a contact form and submit your questions.

If you prefer to speak by phone, call us at 888-209-5049.

Leave A Comment